We’ve all heard the one-liners about energy independence — mostly on the campaign trail of some political windbag who’s praying potential voters don’t call him out.

These stump speeches all begin with the same idea…

We have three times more oil beneath U.S. soil than the proven reserves of Saudi Arabia.

They’re talking about the nearly two trillion barrels of oil that’s ours for the taking.

Then they mention the fact that a single U.S. shale formation could be producing five million barrels per day and that this same shale resource could satiate our oil addiction for a hundred years.

Those claims can be dangerous, because that “shale” buzzword is misleading…

For uninformed investors, “oil shale” is synonymous with the now-famous shale oil plays that sprung up in the United States in 2008 and have been booming ever since.

But there’s a world of a difference between shale oil and oil shale.

Confusing the two can be deadly — especially if you have skin in the game.

Oil Shale Versus Shale Oil

Energy independence is a hot-button issue — especially during an election year.

And it’s of utmost importance to be informed and clear when it comes to the rhetoric.

The claims above are based on oil shale, mostly found in the Green River Formation, which stretches across three basins in Utah, Colorado, and Wyoming.

Many of my veteran readers can pinpoint the problem right off the bat: The “trillions of barrels of oil shale” found here isn’t even oil.

It’s not even technically shale.

It’s kerogen.

In this case, mistaking one for the other is a matter of life and death for your energy portfolio. We’re not talking about an area where companies can set up a rig and start drilling our way to energy independence…

Like the bituminous sands in Canada, there are only two ways to develop this resource: through a surface-mining and retorting process, or from in-situ methods.

Just in case you’re wondering, only a few thousand barrels of oil have been extracted from the Green River Formation in the last century.

So to say economically producing oil from this area would take decades would be optimistic, to say the least. The fact that it takes about one barrel of oil to produce one barrel of oil from this play should be telling.

Luckily, there are much more profitable gambles to make when it comes to the U.S. oil sector…

Unlocking Real Oil Profits

You see, even though we know where much of our remaining oil supplies are located, a better investment strategy is in how we plan on pumping out those barrels.

A few months ago, I talked about why technology will be the linchpin for the U.S. oil and gas industry.

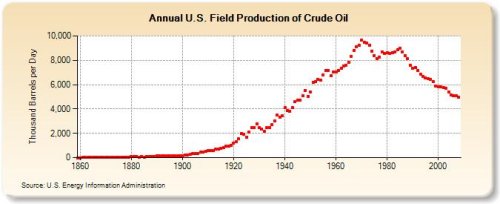

You already know how it’s helped reverse a decades-long decline in our domestic output:

U.S. oil production has since rebounded back over six million barrels per day.

That surge has been due to just one thing: the combination of two existing technologies (in this case, horizontal drilling and hydraulic fracturing).

Aside from these tight oil formations, it’s business as usual everywhere else.

And believe me, that’s not a good thing…

Remember the recent announcement that North Dakota leapfrogged Alaska to become the second-largest producing state in the U.S.?

Both California and Alaska’s crude production are at record lows.

So after witnessing the kind of boom we’ve enjoyed from our tight oil resources (think: the Bakken Formation) during the past five years, you can understand how incredible it would be to open up even more supplies previously believed to be unattainable.

And that’s the next step for us — whether it’s improving on the media-vilified hydraulic fracturing through waterless fracturing techniques, or developing a new technology that can unlock the oil we never thought we’d be able to reach.

If I’d told readers decades ago we’d be drilling 20,000 feet to tap the tight rock formations in the U.S. or going 40,052 feet under water for our future oil and gas supplies, I’d have been laughed out of a room.

But that’s precisely what we’re doing right now just to keep global production afloat.

Furthermore, current drilling and completing methods can only extract so much of the original resource out of the ground, which still leaves a huge chunk of crude untouched…

My colleague Jeff Siegel has been doing the research and due diligence on a small energy company with the technology that allows drillers to produce those previously unattainable barrels of oil.

His report will be out shortly. Be on the lookout for it to hit your inbox.

This could very well mark the next stage of the North American oil boom… and you’ll have a front row seat for these oil profits.

Until next time,

Keith Kohl

A true insider in the technology and energy markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the Managing Editor of Energy & Capital, as well as the investment director of Angel Publishing’s Energy Investor and Technology and Opportunity.

For nearly two decades, Keith has been providing in-depth coverage of the hottest investment trends before they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on key advancements in robotics and AI technology.

Keith’s keen trading acumen and investment research also extend all the way into the complex biotech sector, where he and his readers take advantage of the newest and most groundbreaking medical therapies being developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s to lab scientists grinding out the latest medical technology and treatments. You can join his vast investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.